The Hampton Roads market hit a median list price of $300,000 over the last week in April. Keep in mind that it was only one week, and it was the list price, not the final sales price. April’s median sale price was $285,000, which is an almost 12% increase from April 2020 prices.

Of course, as we go over the next couple of months, we have to keep in mind that year over year numbers are going to be skewed by Covid. Here is the chart for April’s numbers:

Inventory, the number of homes available for sale at any given time, has been slightly increasing. Across Hampton Roads, there are roughly 12% more homes listed for sale in April 2021 than we had in February 2021. This is not at all unusual for this time of year, and based on local market trends the number of homes listed does go up during the late spring and early summer.

While it is a very challenging market for buyers due to the low inventory, we can make a good case that if you are planning to buy a home this year, you should think hard about getting started sooner rather than later. We are hearing that folks are concerned about selling their home and not being able to find a home they want to purchase. While buying is a challenge in this market, we have a couple of different strategies we have been using very effectively for our clients.

Of course, every situation is different and our careful and up to date market analysis means that as the facts change, our advice may change as well. If you are thinking about moving, and you would like to discuss your personal real estate needs, please reply to this email, or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate, so don’t hesitate to give us a call if you have questions.

Mortgage Loans with Little to No Down Payments

We have all been there — living with messy roommates, feuding with loud upstairs neighbors, or trying to get your landlord to fix something, anything. We get it. It is time to get your own place. Maybe you are ready to move out of that rental and you are thinking about buying your own place. But if the thought of a down payment is a bit intimidating? It does not have to be. There are plenty of little to no down payment options that make homeownership even more attainable now.

What is a down payment?

When you buy a home, you know to expect a monthly mortgage payment that will be yours for 15 or 30 years, or until you have paid off the loan balance. The down payment, on the other hand, is a one-time cost that you will be responsible for paying at closing. Depending on the loan program you choose, your down payment could range from nothing all the way up to 20% of the purchase price (or even more, if you choose). Fortunately, there are many mortgage programs available that meet the needs of most homebuyers.

So how much do you need?

Generally, a conventional loan will require at least 3% down. Or, if you want to avoid Private Mortgage Insurance (or PMI), 20% down is required. But if you are not able to put that much down at once, there are some government-backed loans that range from 0-3.5% down. A few government-insured options that you may consider include:

- FHA loan – This program requires buyers to put down 3.5% of the home’s purchase price and will come with monthly mortgage insurance.

- USDA loan – This program has no down payment, but mortgage insurance is required and can be paid upfront or financed into the loan for borrowers buying a home in an eligible rural area.

- VA loan – This program is tailored specifically to active-duty military, their families, and veterans and requires no down payment or monthly mortgage insurance, but the VA Guarantee Fee replaces mortgage insurance and is paid upfront.

Start Saving

It is never too early to contact a mortgage banker to talk about your options. Once you have determined the amount of home you qualify for, you can see if you are ready to buy now, or if it would be smarter to wait a while longer and keep saving money for a down payment. So, what are some ways to start saving now? Save your tax refund. If you are getting a large refund, put that directly into your savings as if you never had it to spend. Might be hard, but it is a good chunk to start with. Reduce expenses. Take a look at how you’re spending your money. Listing out your expenses can really be an eye-opening exercise on your spending habits. Sell your stuff. But remember, this is not spending money, it is saving money now. When you are ready to take the first step toward homeownership, contact a mortgage banker to get started.

Bill Duggan Sr. Mortgage Banker 757-615-5172 or billduggan@atlanticbay.com

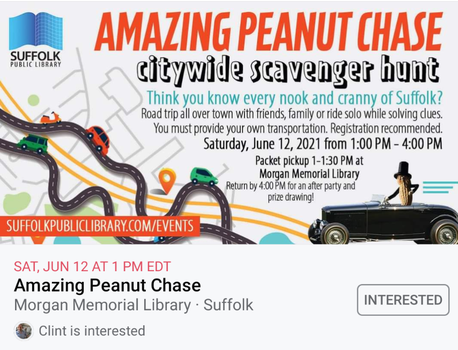

Amazing Peanut Chase

Think you know every nook and cranny in Suffolk? Come prove it at the library’s sixth annual Amazing Peanut Chase! This year’s city-wide scavenger hunt will have you road tripping all over town solving clues. Then join us outside for the socially-distanced after party!

Register at the link: http://ow.ly/YksJ50EQEBr

Keep in touch with the library by signing up for email updates at https://www.suffolkpubliclibrary.com/236/Stay-Informed

Summer Family Movie Series

Join Suffolk Tourism, in partnership with the Suffolk Center for Cultural Arts, as they proudly present The Addams Family on Sunday, June 13, 2021.

Admission is $1 per person, and the movie will begin at 2pm. Please note that only 160 seats are available, to allow for social distancing in the 530-seat Birdsong Theater; masks are required.

For more information or to purchase tickets, please contact the Suffolk Center for Cultural Arts box office at 757.923.2900 or visit SuffolkCenter.org.