Lee Cross Real Estate Update

September 2021

Steady, Steady . . .

Last month we asked the question: Is the local real estate market changing? Based on the latest year over year (August 2020 compared to August 2021) statistics, our answer is still no, the market isn’t changing. For last month’s entire update, CLICK HERE.

It might seem that the local demand from buyers is cooling off a hair, but as you can see from the chart, the number of homes listed for sale is still decreasing and the number of homes selling is increasing based on year over year numbers. At some point that trend will change, but for now we feel we are still in a very strong sellers market.

The majority of homes are still going under contract within two weeks of being listed and the median sales price is up 12.1% since the beginning of this year. I would be surprised if that trend doesn’t continue when the numbers for the next couple of months are finalized.

These statistics represent averages across Hampton Roads and your individual real estate needs might be different. If you are thinking about moving and you would like to discuss your personal real estate needs, please reply to this email, or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate, so don’t hesitate to give us a call if you have questions.

Thanks,

Lee and Harry

It’s Time For The Peanut Festival!

43rd Annual Suffolk Peanut Festival

It’s back and it”s better than ever! Known for its fun family activities, amusement rides, games, concerts, fireworks, shrimp feast, and demolition derby, the 43rd Annual Penaut Fest is back. Visit the Swamp Roar Motorcycle Rally, pony rides, straw maze, arts & crafts, and monster truck rides. Get in the game with peanut butter sculpting, kiddie fun, corn hole, karaoke, and so much more!

The fun starts on Friday, October 8, and runs through Sunday, October 10.

General admission is $10 per person; Children 10 & under are free. Parking is free.

| Driver Days Fall Festival |

Celebrating it’s 28th year, the Driver Days Fall Festival offer two days full of free family fun, including: Entertainment, Carnival Games, Pony & Train Rides, Food, Car Show, Parade, Crafters & Food Vendors, and more!

Free parking is available at Titan Contractors on Nansemond Parkway. $5 parking is available at Berea Christian Church.

Saturday, October 16:

10am – 6pm

Sunday, October 17:

11am-5pm

For more information, visit DriverEvents.com.

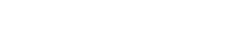

Is The Market Changing?

Is the real estate market across Hampton Roads really changing or are the numbers misleading? Let’s start with the latest year over year (July 2020 compared to July 2021) statistics found here:

An argument could be made that the market is “slowing down” but we aren’t ready to say that yet. New construction numbers are down because builders sold through a good part of the available inventory, and we believe not having enough homes to sell is the same reason pending sales are down. Even though the number of homes under contract are decreasing, the median sales price continues to increase. In June 2021 the median sales price was $298,470, and in July 2021 it was an even $300,000. It is only about half a percent difference but it shows a steady rise.

We’ve seen this trend before but there are significant differences in this cycle. From 2000 to 2005 the total number of homes sold across Hampton Roads went up each year, increasing the inventory. In both 2006 and 2007 the numbers of homes decreased, but the median sale price increased each year. In fact, over 20% fewer homes were sold in Hampton Roads in 2007 than in 2005, but the median sales price of the homes that sold in 2007 was over 10% higher. Locally prices didn’t start to go down until 2008. Lender standards are much tighter now than they were in 2005-2007, so hopefully history will not repeat itself in such a dramatic fashion.

These statistics represent averages across Hampton Roads and your individual real estate needs might be different. If you are thinking about moving and you would like to discuss your personal real estate needs, please reply to this email, or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate, so don’t hesitate to give us a call if you have questions.

Thanks,

Lee and Harry

What is pre-approval?

A mortgage pre-approval carries more weight and goes a step further than pre-qualifying. We will take more of a deep dive into your financial health, your income and assets, employment and debts. Essentially, your loan is going through upfront underwriting and puts you on the fast-track to homebuying.

What you need for a pre-approval

Here’s where you need to provide:

- Employment verification (W-2’s or 1099s)

- Bank statements

- Retirement and Brokerage account statements

- Other assets

- Current real estate debt or rental statements

- Monthly debt payments (student or auto loans, credit card or utility bills etc.)

- Court orders (divorce, child support, alimony, etc.)

- Tax returns

- Down payment amount

Our team looks at your entire financial make-up to get a complete picture of your buying power. Once you’ve given us everything we need, we will give you a pre-approval letter that shows you how much you can afford based on your current financial health. This is invaluable to agents you meet along the way on your house hunt!

If you’re serious about purchasing a home, and you’re ready to take the next step in the process before falling in love with your dream home, then getting pre-approved is the natural next step! Let’s get you on your way to finding the home of your dreams!

Bill Duggan Sr. Mortgage Banker 757-615-5172 or billduggan@atlanticbay.com

Taste of Suffolk Downtown Street Festival

Taste of Suffolk is back in Downtown Suffolk for the 15th year! This annual street festival tradition spans Main Street from Finney Avenue to Washington Street.

Taste treats from local restaurants and see crafters, vendors and merchants. Taste of Suffolk has something for the whole family with a great children’s area and live entertainment by The Whiskey Rebellion, Rajazz, Jason Cale Band, Brianna Marie, and Anthony Rosano. Enjoy contests and games, a beer garden, and a new vehicle exhibition.

Head downtown on Saturday, September 11th from 11:00sm to 5:00pm.

For more information visit TasteofSuffolkVa.com.

For Kids Field Day

Make Time to Play!

Join the 2nd annual Field Day ForKids at Cedar Point Club in Suffolk on Thursday, September 30th.

Pick and play your favorite activity to support the mission to break the cycle of poverty and homelessness in Western Tidewater.

Visit www.forkids.org or contact Mary Crosby at 757.622.6400 ext 135 for more infomration and registration.

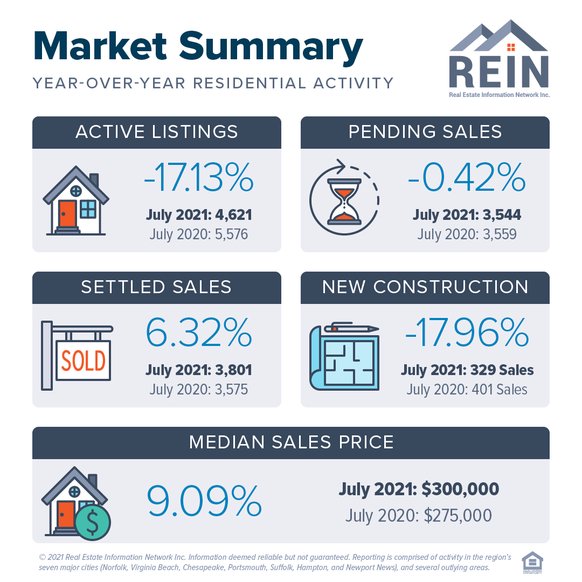

Getting Paid $35,871 to Wait?

This weekend I (Lee) was visiting friends who are also past clients. They bought a new home in 2019 but made the joke that even though they had been too busy to get their old home ready for sale, it will be to their benefit because prices have increased so much over the last year. Based on the information from the Real Estate Information Network (our local MLS) the Median Sales price for Hampton Roads is up 13.66% from June 2020 to June 2021. Using the median sales price that is a difference of $35,871!

Most of those gains have occurred in 2021. Prices were trending up during 2020 and they continue to rise in 2021. Prices have increased by 9.3% when comparing the median sales price of a Hampton Roads home during the first week of January 2021 to the first full week of June 2021.

Things are moving quickly now but August is usually a slower time of year for real estate sales so it will be interesting to see if that trend prevails in the current market. There continues to be an increased amount of demand from buyers and a lack of homes listed for sale. There were 27.80% fewer active listings in June 2021 than their were in June 2020. Those factors could combine for a busier than average August!

As the year goes on, the year over year comparisons will be skewed due to the Covid shutdowns but it is clear we are still in a hot seller’s market.

If you are on the fence about selling, we are always happy to give you a free market analysis on your home. There is no obligation on your part and you might be surprised to see what your home is worth in today’s market. Reply to this email or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate and are always happy to talk!

It’s Time for the 32nd Nansemond Indian Pow Wow

All are welcome at this family-friendly event featuring Native American song, dance, food, and crafts. Admission is free.

Saturday: 10am-6pm (Grand Entry at 12pm)

Sunday: 10am-5pm (Grand Entry at 1pm)

The Pow Wow grounds are located at 1001 Pembroke Lane, Suffolk, VA, 23434.

For more information, visit Nansemond.org.

Public health protocols will be in place. No drugs, alcohol, or pets.

Summer Family Movie Series

Time for Trolls World Tour!

Join the Suffolk Center for Cultural Arts, as they proudly present Trolls World Tour on Sunday, August 8, 2021. Admission is $1 per person, and the movie will begin at 2pm.

The movie is filled with music by the talented cast that includes Anna Kendrick, Justin Timberlake, James Corden, Rachel Bloom, and Kelly Clarkson. This film is rated PG and has a running time of 90 minutes. All children must be accompanied by an adult.

For more information or to purchase tickets, please contact the Suffolk Center for Cultural Arts box office at 757.923.2900 or visit SuffolkCenter.org.

Increases All Around

The Hampton Roads market hit a median list price of $300,000 over the last week in April. Keep in mind that it was only one week, and it was the list price, not the final sales price. April’s median sale price was $285,000, which is an almost 12% increase from April 2020 prices.

Of course, as we go over the next couple of months, we have to keep in mind that year over year numbers are going to be skewed by Covid. Here is the chart for April’s numbers:

Inventory, the number of homes available for sale at any given time, has been slightly increasing. Across Hampton Roads, there are roughly 12% more homes listed for sale in April 2021 than we had in February 2021. This is not at all unusual for this time of year, and based on local market trends the number of homes listed does go up during the late spring and early summer.

While it is a very challenging market for buyers due to the low inventory, we can make a good case that if you are planning to buy a home this year, you should think hard about getting started sooner rather than later. We are hearing that folks are concerned about selling their home and not being able to find a home they want to purchase. While buying is a challenge in this market, we have a couple of different strategies we have been using very effectively for our clients.

Of course, every situation is different and our careful and up to date market analysis means that as the facts change, our advice may change as well. If you are thinking about moving, and you would like to discuss your personal real estate needs, please reply to this email, or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate, so don’t hesitate to give us a call if you have questions.

Mortgage Loans with Little to No Down Payments

We have all been there — living with messy roommates, feuding with loud upstairs neighbors, or trying to get your landlord to fix something, anything. We get it. It is time to get your own place. Maybe you are ready to move out of that rental and you are thinking about buying your own place. But if the thought of a down payment is a bit intimidating? It does not have to be. There are plenty of little to no down payment options that make homeownership even more attainable now.

What is a down payment?

When you buy a home, you know to expect a monthly mortgage payment that will be yours for 15 or 30 years, or until you have paid off the loan balance. The down payment, on the other hand, is a one-time cost that you will be responsible for paying at closing. Depending on the loan program you choose, your down payment could range from nothing all the way up to 20% of the purchase price (or even more, if you choose). Fortunately, there are many mortgage programs available that meet the needs of most homebuyers.

So how much do you need?

Generally, a conventional loan will require at least 3% down. Or, if you want to avoid Private Mortgage Insurance (or PMI), 20% down is required. But if you are not able to put that much down at once, there are some government-backed loans that range from 0-3.5% down. A few government-insured options that you may consider include:

- FHA loan – This program requires buyers to put down 3.5% of the home’s purchase price and will come with monthly mortgage insurance.

- USDA loan – This program has no down payment, but mortgage insurance is required and can be paid upfront or financed into the loan for borrowers buying a home in an eligible rural area.

- VA loan – This program is tailored specifically to active-duty military, their families, and veterans and requires no down payment or monthly mortgage insurance, but the VA Guarantee Fee replaces mortgage insurance and is paid upfront.

So how much do you need?

Generally, a conventional loan will require at least 3% down. Or, if you want to avoid Private Mortgage Insurance (or PMI), 20% down is required. But if you are not able to put that much down at once, there are some government-backed loans that range from 0-3.5% down. A few government-insured options that you may consider include:

- FHA loan – This program requires buyers to put down 3.5% of the home’s purchase price and will come with monthly mortgage insurance.

- USDA loan – This program has no down payment, but mortgage insurance is required and can be paid upfront or financed into the loan for borrowers buying a home in an eligible rural area.

- VA loan – This program is tailored specifically to active-duty military, their families, and veterans and requires no down payment or monthly mortgage insurance, but the VA Guarantee Fee replaces mortgage insurance and is paid upfront.

Start Saving

It is never too early to contact a mortgage banker to talk about your options. Once you have determined the amount of home you qualify for, you can see if you are ready to buy now, or if it would be smarter to wait a while longer and keep saving money for a down payment. So, what are some ways to start saving now? Save your tax refund. If you are getting a large refund, put that directly into your savings as if you never had it to spend. Might be hard, but it is a good chunk to start with. Reduce expenses. Take a look at how you’re spending your money. Listing out your expenses can really be an eye-opening exercise on your spending habits. Sell your stuff. But remember, this is not spending money, it is saving money now. When you are ready to take the first step toward homeownership, contact a mortgage banker to get started.

Bill Duggan Sr. Mortgage Banker 757-615-5172 or billduggan@atlanticbay.com

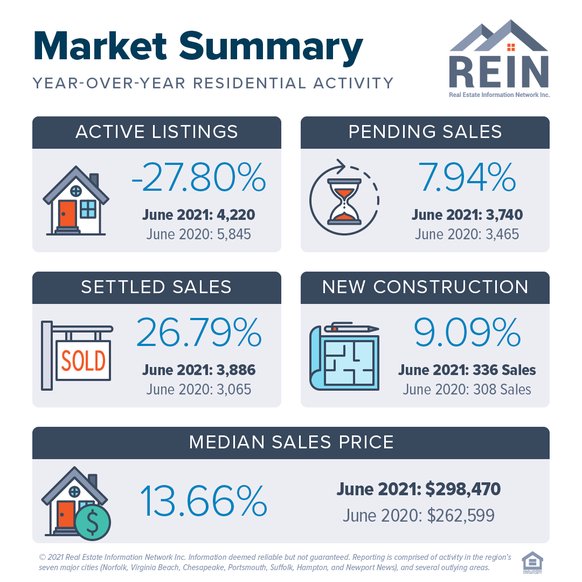

Amazing Peanut Chase

Think you know every nook and cranny in Suffolk? Come prove it at the library’s sixth annual Amazing Peanut Chase! This year’s city-wide scavenger hunt will have ySummer Family Movie Seriesou road tripping all over town solving clues. Then join us outside for the socially-distanced after party!

Register at the link below:http://ow.ly/YksJ50EQEBr

Keep in touch with the library by signing up for email updates at

https://www.suffolkpubliclibrary.com/236/Stay-Informed

Summer Family Movie Series

Join Suffolk Tourism, in partnership with the Suffolk Center for Cultural Arts, as they proudly present The Addams Family on Sunday, June 13, 2021.

Admission is $1 per person, and the movie will begin at 2pm. Please note that only 160 seats are available, to allow for social distancing in the 530-seat Birdsong Theater; masks are required.

For more information or to purchase tickets, please contact the Suffolk Center for Cultural Arts box office at 757.923.2900 or visit www.SuffolkCenter.org.

Increases All Around

The Hampton Roads market hit a median list price of $300,000 over the last week in April. Keep in mind that it was only one week, and it was the list price, not the final sales price. April’s median sale price was $285,000, which is an almost 12% increase from April 2020 prices.

Of course, as we go over the next couple of months, we have to keep in mind that year over year numbers are going to be skewed by Covid. Here is the chart for April’s numbers:

Inventory, the number of homes available for sale at any given time, has been slightly increasing. Across Hampton Roads, there are roughly 12% more homes listed for sale in April 2021 than we had in February 2021. This is not at all unusual for this time of year, and based on local market trends the number of homes listed does go up during the late spring and early summer.

While it is a very challenging market for buyers due to the low inventory, we can make a good case that if you are planning to buy a home this year, you should think hard about getting started sooner rather than later. We are hearing that folks are concerned about selling their home and not being able to find a home they want to purchase. While buying is a challenge in this market, we have a couple of different strategies we have been using very effectively for our clients.

Of course, every situation is different and our careful and up to date market analysis means that as the facts change, our advice may change as well. If you are thinking about moving, and you would like to discuss your personal real estate needs, please reply to this email, or give us a call (757-726-7653 for Lee, 757-434-9084 for Harry). We love talking real estate, so don’t hesitate to give us a call if you have questions.

Mortgage Loans with Little to No Down Payments

We have all been there — living with messy roommates, feuding with loud upstairs neighbors, or trying to get your landlord to fix something, anything. We get it. It is time to get your own place. Maybe you are ready to move out of that rental and you are thinking about buying your own place. But if the thought of a down payment is a bit intimidating? It does not have to be. There are plenty of little to no down payment options that make homeownership even more attainable now.

What is a down payment?

When you buy a home, you know to expect a monthly mortgage payment that will be yours for 15 or 30 years, or until you have paid off the loan balance. The down payment, on the other hand, is a one-time cost that you will be responsible for paying at closing. Depending on the loan program you choose, your down payment could range from nothing all the way up to 20% of the purchase price (or even more, if you choose). Fortunately, there are many mortgage programs available that meet the needs of most homebuyers.

So how much do you need?

Generally, a conventional loan will require at least 3% down. Or, if you want to avoid Private Mortgage Insurance (or PMI), 20% down is required. But if you are not able to put that much down at once, there are some government-backed loans that range from 0-3.5% down. A few government-insured options that you may consider include:

- FHA loan – This program requires buyers to put down 3.5% of the home’s purchase price and will come with monthly mortgage insurance.

- USDA loan – This program has no down payment, but mortgage insurance is required and can be paid upfront or financed into the loan for borrowers buying a home in an eligible rural area.

- VA loan – This program is tailored specifically to active-duty military, their families, and veterans and requires no down payment or monthly mortgage insurance, but the VA Guarantee Fee replaces mortgage insurance and is paid upfront.

Start Saving

It is never too early to contact a mortgage banker to talk about your options. Once you have determined the amount of home you qualify for, you can see if you are ready to buy now, or if it would be smarter to wait a while longer and keep saving money for a down payment. So, what are some ways to start saving now? Save your tax refund. If you are getting a large refund, put that directly into your savings as if you never had it to spend. Might be hard, but it is a good chunk to start with. Reduce expenses. Take a look at how you’re spending your money. Listing out your expenses can really be an eye-opening exercise on your spending habits. Sell your stuff. But remember, this is not spending money, it is saving money now. When you are ready to take the first step toward homeownership, contact a mortgage banker to get started.

Bill Duggan Sr. Mortgage Banker 757-615-5172 or billduggan@atlanticbay.com

Amazing Peanut Chase

Think you know every nook and cranny in Suffolk? Come prove it at the library’s sixth annual Amazing Peanut Chase! This year’s city-wide scavenger hunt will have you road tripping all over town solving clues. Then join us outside for the socially-distanced after party!

Register at the link: http://ow.ly/YksJ50EQEBr

Keep in touch with the library by signing up for email updates at https://www.suffolkpubliclibrary.com/236/Stay-Informed

Summer Family Movie Series

Join Suffolk Tourism, in partnership with the Suffolk Center for Cultural Arts, as they proudly present The Addams Family on Sunday, June 13, 2021.

Admission is $1 per person, and the movie will begin at 2pm. Please note that only 160 seats are available, to allow for social distancing in the 530-seat Birdsong Theater; masks are required.

For more information or to purchase tickets, please contact the Suffolk Center for Cultural Arts box office at 757.923.2900 or visit SuffolkCenter.org.