Mar 22, 2012

Welcome to Spring! The time for flowers and home buyers. Our market is better, but it is hard for the average buyer or seller to see the change. Maybe the right term is “headed in a better direction”. Certainly not fixed yet, but here is why I know it is better. The overall absorption rate has dropped from a high of 9.27 months to clear the inventory last August to 7.5 months in January 2012. This is good news, means that there have been sales and the number of listings is starting to come down. We would like to see 5-6 month absorption rate for a more balanced market. That is probably not going to happen this year.

Distressed sales, which are bank owned, foreclosures and short sales are still too much a part of the market. In January they were 37% of all sales in the Hampton Roads area. There is a difference in the median sales price of distressed sales at $125,000.00 and non-distressed sales at $182,000.00. The upper priced market continues to suffer from lack of demand.

Over all the market feels better to me and we have seen a spike in sales in January and February at Cross Realty. Now lets see if this will last!

My son, Lee and I have been doing business together for a few years now. So, if you are using us, you get two award winning brokers, high tech tools and expert negotiation skills on your side. You will see some of our new ads (see below) and billboards out and about. So, let us help you and your friends get the most you can for your property. Price it right the first time and it will sell. We know where that is, call us 726-SOLD (7653) and thanks for your referrals.

Feb 21, 2012

The question that I am asked most often is: IS THE MARKET BETTER OR GETTING BETTER? The answer is yes and yes, and of course there is a BUT! What is better, is that prices are much more affordable and consequently we are seeing more demand. The market will continue to get better over time in direct relationship to the improvement in the economic environment. The economic news I read and hear is that it is anywhere from this year to 2014. We are fortunate to have the stability of the Navy and other government influences with jobs and salaries in our Hampton Roads area. BUT it is the other major employers and small businesses that need to get back on track to make the economy start to go. I do not see the real estate market turning around this year and 2014 is probably when it will happen, in my opinion.

The other question I get is: CAN THE GOVERNMENT HELP THE REAL ESTATE MARKET? They have not so far. None of their attempts have made more than a small dent in the problem and most have done nothing to help. Such as the $8000.00 rebate to first time home owners. It did help sell some homes. The idea was that if the first time home buyers purchased properties, then those sellers would move up. Never happened, the first timers purchased mostly repos or bank owned properties. Unfortunately, most of the people who purchased these homes are now in a situation where their homes are “underwater”. They owe more than their home is worth.

One possible help to “underwater” home owners is a program that will allow them to refinance on their ability to pay, income and credit score; not on the appraised value of their home. This will allow them to take advantage of the lower rates and will save them some money. That is the program that needs to be in place for homeowners and it could stop a number of foreclosures.

Jan 24, 2012

Good-bye 2011! Each year that goes by gets us a little closer to a better market! It is simply going to take time to work through the foreclosure inventory and for the economy to get to a better place. REIN MLS gives some good statistical data and from that it shows some positive indications. The best was that the December closings were 104 in Suffolk, which matched May closings as the top month. We had a surge at Cross Realty and I think it may have had to do with banks dumping some inventory and great interest rates. Another good sign was that the Medium Sales Price went up, close to $230,000.00 in Suffolk. That was about a $5,000 increase over the last few months. Again a good sign, but I am not sure it is sustainable. We will see.

Our rental market continues to be strong. Cross Realty manages over 300 properties and we continue to have a good record of having them 98% rented. We have been in the rental management business for 59 years and that factor helps with contacts and referrals.

Interest rates are in the 3.9% range. Good time to refinance if your appraisal is above your loan value. It is estimated that about one-third of the homes in the market are “underwater”, their loan is higher than their current market value. We know where your home will sell. It is all about supply, demand, cost of money, the economy and absorption rate. Call us, we can help you. 2012 is going to be a great year!

Dec 16, 2011

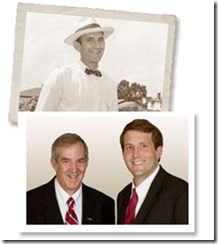

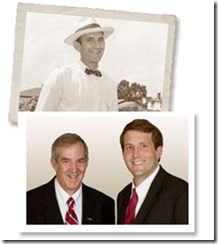

I want to take this opportunity to thank all those that gave us the privilege to work with them this year through Cross Realty’s Sales and Rental Companies. My Father started this business 58 years ago with a vision to help clients with all their real estate buying, selling and leasing needs. He also made it a company policy to give back to the community in time, talent and a portion of the company income to help where needed in the Suffolk community. I realize that I am blessed to be able to continue that tradition. It has been a very difficult time for our economy and that makes me appreciate even more our ability to help others.

I want to take this opportunity to thank all those that gave us the privilege to work with them this year through Cross Realty’s Sales and Rental Companies. My Father started this business 58 years ago with a vision to help clients with all their real estate buying, selling and leasing needs. He also made it a company policy to give back to the community in time, talent and a portion of the company income to help where needed in the Suffolk community. I realize that I am blessed to be able to continue that tradition. It has been a very difficult time for our economy and that makes me appreciate even more our ability to help others.

Now let’s talk about INVESTMENT, that is Human Investment. Our society does a pretty good job to make sure that there is a Thanksgiving Dinner or presents for Christmas for our community. But there are 363 more days in the year. I encourage you this year to make one extra Human Investment that might help on those other days. There are lots of places to do so. You probably have already thought of which one you want to do. So be that Secret Santa and make one more investment this year.

Hope you enjoy this Special Christmas Season and from all of us at Cross Realty, thanks for the privilege of being your Realtor.

Harry L. Cross, III

Broker/Owner

Nov 21, 2011

One of the things happening in the real estate market across the county is the proliferation of market data being presented on the internet about individual properties. The idea is that the provider that has the “richest” site that is easiest to navigate will capture the buyers. There are a number of players in this market: Zip, Zillow, Trulia, RPR/Realtors and Cross Realty. Yes, we are in the internet fight to capture business! The MLS system serving Hampton Roads does an excellent job of projecting listings to multiple sites and our content keeps growing, but it will be tough to compete with the major internet players in the short run. No telling where all this is going, maybe a national MLS. Buyers and Sellers still need local experts to really understand their opportunities and challenges. Knowledge and experience is still the key to getting properties sold and finding that right property at the best price.

As to our local market, we are still fighting the Repo problem. They are 25% of our listings and getting close to 40% of our sales. This tends to lower the average sales price.

Have a great Thanksgiving and lets all be thankful for our blessings.

Oct 18, 2011

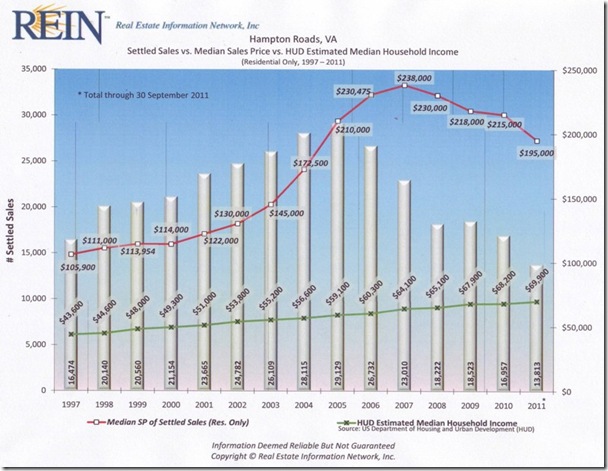

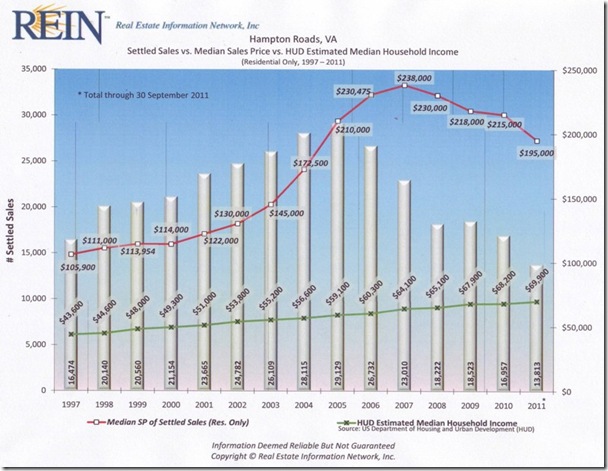

October is one of my favorite months. The leaves turn and the heat is gone. Not much heat in the real estate business. Rates are still great (FHA 4.125/30 yr, Conventional. 3.625/15 yr). The REIN MLS system puts out some great graphs that show what has happened in the market. Below is a graph that shows you the real estate “bubble”, when it happened and what happened. Essentially the local market went from average growth from 1997 to 2001, and then ballooned with an average price going from $122,000.00 in 2001 to $238,000 in 2007. As the market “bubble” burst with the financial crisis and economic downward spiral, the median price came down to $195,000. If you look at Supply of Listings and Demand for those Listings, you get the same picture and same effect. Looks like we may not be completely through with a downward trend. It is all about the economy and jobs. I doubt this Congress can get its act together to help stabilize the economy. If a seller understands where to price their home, it will sell. We know where that is, call us.

Page 7 of 11« First«...56789...»Last »