May 14, 2013

Is the Market in Suffolk Really Better?

I think the answer is YES. We have experienced more buyers in the market and more good listings that are not “short sales”. We actually had two homes with multiple offers. That was a shocker. The overall number of residential listings is going down and in Hampton Roads the number of pending and under contract reports is up over last year. The current supply of inventory is 6.02 months according to the REIN MLS system. We would like to see it in the five range.

All good news for a seller. The region’s residential median sales price is $199,250.00 which is up slightly from last month.

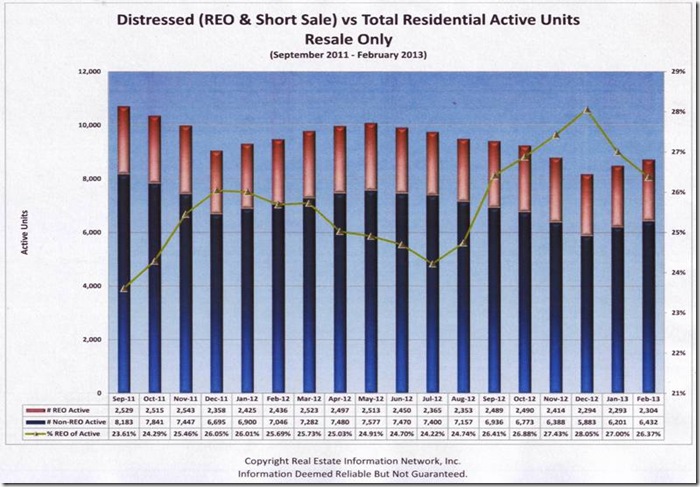

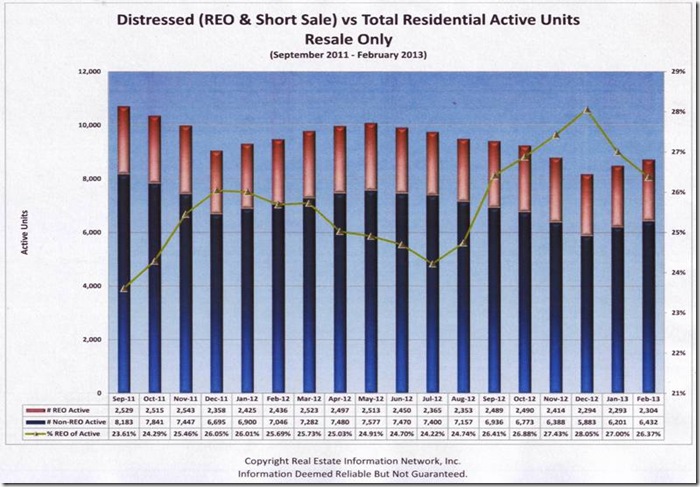

Short sales and bank owned listings are still 27.76% of the market, which is way too high for the market to be in balance.

The challenges are still in the bank owned properties holding values down. Having a better over all economy will help with a lot of issues. Interest rates are still great at around 3.375% for 30 years and 2.7% for 15 years. Refinance now, because the prediction is, these are going to go up.

How can we help you or a friend? Referrals are how we do most of our business.

Summer is coming, as soon as we get over global cooling!!!

Mar 19, 2013

The market continues to improve. Since all sales are determined by Supply and Demand, then changes in either indicates movement in a plus or minus direction. In 2011 the total number of listings in our Hampton Roads market was 16,945, today it is 9,285. This is a 45% reduction. Definitely going in the right direction, getting closer to a normal number, but our challenge is still in the overall economy and the continued stalemate in Congress. Major business decisions are being held up because we have no direction from our elected leaders. The over all rating of Congress before was bad, but now I think they deserve an F-. We should have voted them out when we had the chance last time. Maybe we will be smarter next time!

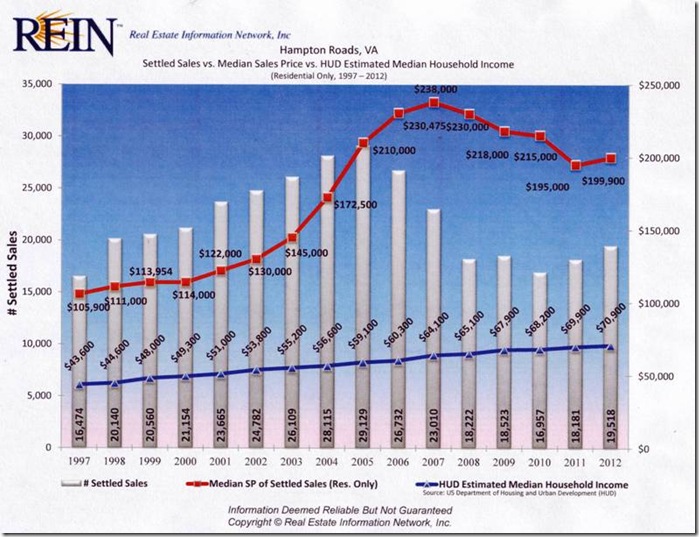

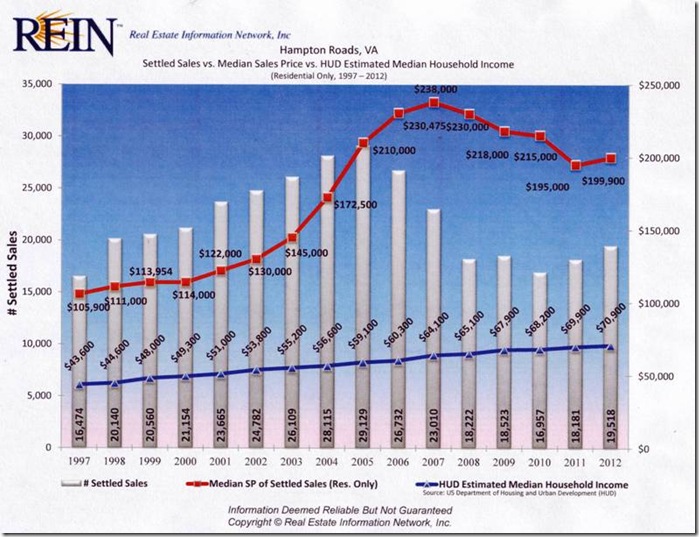

Below are two informative charts. Settled Sales show the history of how we got into this mess and for the first time since 2007 shows an increase in home values, overall. The second chart shows the influence of Distressed sales on the market. They are still at 26.37%, which is a huge negative influence on the sales price of homes. To get better prices we need for the Distressed sales to be much less.

If Sequestration does not overly affect the Hampton Roads economy, then we will continue to improve. But my guess is that the Sequestration will slow down recovery for our area. It is about a Congress that is not doing its job that is holding everything back. Let’s call for a new election! You In?

Send me one client this year! Have you been to Sweet Frog yet on Main St. near Panera?

Feb 18, 2013

Two Common Sense Secrets for Selling Your Home:

Most secrets for selling your home are just common sense, if you think about it. The two items that affect the sale of a home most are “Price and Presentation”.

Price: Buyers go to internet sites multiple times, looking at homes, before they ever contact anyone. Their search is usually from the lowest price, for what they are looking for, to the highest they can afford. If you are not priced right, you don’t even make their search. This is called the “Selling Zone”. I estimate that 70% of the market is priced above their “Selling Zone” and simply have little chance to sell.

Presentation: It’s all about good photos & virtual tours. Yes, perspective buyers will want to actually walk through the home, but to get them to that point, pictures are what grabs their attention. Below are some pictures that will grab a buyers attention. Our staff photographer, Suzanne Pruitt, has a real eye for catching just the right angle of a house. She has a great sense of a ‘special” place in the home. I always ask a seller, “What do you like best about your house?”. I always get great answers. Some times the answer is the light coming through the kitchen window, the porch that’s great for taking a nap or reading a book, where the Christmas tree always stands, or that “special’ place the kids read to go to far off places.

Homes are special. Don’t you want one? Call Cross Realty, we understand Price & Presentation!

Dec 17, 2012

At the end of this year, I would have been in the Real Estate Business in Suffolk, Virginia for forty years. My Dad, who taught us this business, always had a wonderful time at Christmas. It was a time for him to celebrate another successful year in the business helping clients achieve real estate dreams, whether it was buying, selling or finally renting a home of their own. We still have the privilege of working with friends and new friends to find that perfect home, sell a home or lease a good place for their family.

When I got in the business, there were no MLS, no computers, no cell phones, no calculators, no copy machines and no Internet. I used a “slide rule” to calculate square footage. Do you know what one of those looks like? Today I have more access to market information on a smart phone than we had on good computers just a few years ago. Cameras are obsolete and “real time” is where we live and work.

But Some things never change: good old professional advice, trust and vision. We help our clients understand the current market so they can make good decisions. As I reflect on this year and how much the market has changed for the good, I am thankful that we are headed in the right direction for sellers and home prices. It may be a slow road back to normal, but we are headed in the right direction.

I like Christmas at the office, too. The decorations the staff pulls out and puts up we have used for years. They all have stories we remember and share. A few photos of them are below. They bring warmth and smiles and memories.

Wishing you and yours the best of the Holiday Season and thanks for 40 years of old friends and new friends. Looking forward to more of the same!

Harry L. Cross, III

Broker/Owner

Nov 19, 2012

THANKFUL FOR AN IMPROVING REAL ESTATE MARKET-SEE HOW MUCH!

As we approach Thanksgiving, I am thankful for an improving real estate market. Here are some good numbers for a change according to the REIN MLS statics. Sales are up over this time last year by 14.4% and sale prices are up 5% over the same time period. The Old Dominion Economic Forecasting Dean, Vinod Agarwal, noted in the Virginian Pilot that he sees a market that is continuing to improve. The challenge is that although the number of listings has decreased, the number of bank owned and distressed property sales are still at 28%, which simply is an indication of a stressed market. Active listings in our market dropped by 12%. We need for the supply of homes to decrease in order to stabilize the market.

All of these factors point toward an improving market. The rate of improvement is just painfully slow. At Cross Realty we did experience more demand last month and had a number of homes go under contract, but there is lots more inventory to work through. I was showing homes with 1 to 10 acres in rural areas Saturday and four of the six houses we viewed were bank owned or in a short sale position.

I am still thankful that the market is heading in the right direction. Knowing where to price a listing is critical to being competitive and getting sold. We know where that price point is, call us we can help you.

I wish all of you a wonderful Thanksgiving!

Oct 26, 2012

How will the election affect the housing market?

How will the election results effect the housing market? Good question, no solid answers, but here is my best guess. If Obama wins, then very little will change. Interest rates will need to stay low or the government will have to pay a lot more interest on our National Debt, which we can not afford. The programs that the current administration tried to help the housing crisis have not worked. Their purpose was to keep people in their homes, cut the foreclosure numbers and thereby decrease the listing inventory. There were no appreciable results from any of their attempts and I would ask, who were they getting advise from? I see very little change if the current administration stays in office.

So what might Romney do if he gets in? He really does not have a lot of good options. We certainly can not increase the debt to bail out the upside down homeowners. He could work with the banks to make the short sale process happen in a timely manner and get answers to owners and buyers by putting time lines on response times. He could force the banks and lending institution, to allow underwater home owners to refinance at a lower rate for their current loan amounts.

To get the housing market back on a level playing field the inventory must be reduced and we have to have a better economy. The housing market is moving in the right direction, but oh so slowly. In my opinion, Congress and the President, who ever it is, must give the business community some straight answers on where they stand and how health care is going to go or we will simply continue to muddle through in this recovery.

I would love to hear some of your thoughts on this subject. Care to speak up?!!!

Click the link below to see an interesting article from The Washington Post:

http://www.washingtonpost.com/realestate/how-the-presidential-election-affects-the-real-estate-market/2012/08/30/ccefd218-e585-11e1-8741-940e3f6dbf48_story.html

Page 5 of 11« First«...34567...10...»Last »